Updating of your bank details and cell phone number is vital if you want to make sure that you get your payments on time so that we make certain each month you get what should be coming. Timely payments are important; as such, incorrect accounts could bring in delayed pay, payments are “revoked” and backward SMS alerts. The South Africa Social Security Agency has made the process easier by offering an online service for recipients looking to update their information. Many details have been provided below to make your update process smoother.

Why Updating Your Details Is Important

For SASSA to pay grants and all important messages given out to beneficiaries that rely on any given mobile number or bank account are not in active mode; payments may be missed.

Some Updates on Steps to Be Taken to Update Banking Details

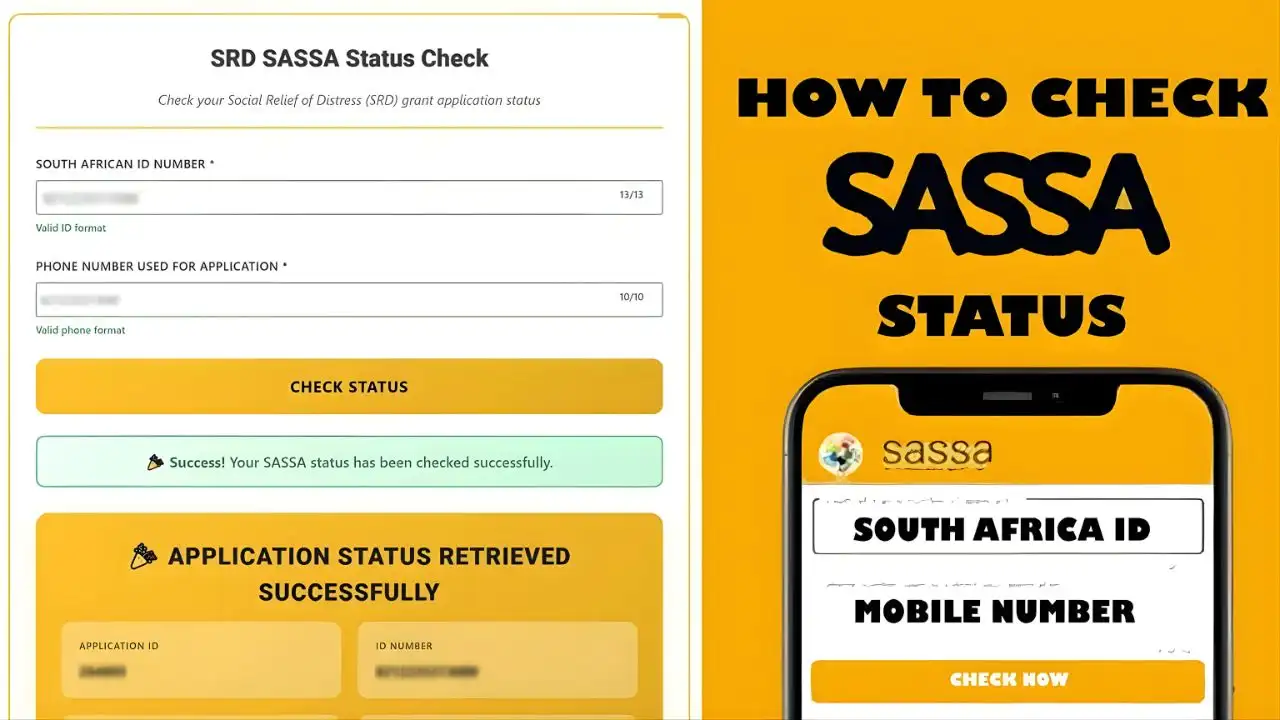

In order to finally update your bank details, visit the official SASSA Services website. It is possible to supply with your South African Boot Citation Number, your registered cellphone number, as well as the new banking details to add your new bank account information. SASSA sends you a safe One-Time-Pin for your cellphone after you have entered the number into the system on the portal. After OTP submission, it is for you to select your bank and enter the new account details. Normally, it would take a couple days for the update to reflect, since SASSA have to confirm that the account is actually yours.

Changing Your Phone Number

Updating your cellular number can become relatively critical since SASSA employs an SMS notification system for the settlement of payments and a notification system for all verifications. To initiate a change in your mobile number, proceed to the online portal where you originally activated the online SASSA profile. The system will ask you to key in your confidential ID number then verify with the old number. If sending an SMS verification to the old number fails, additional verification will be needed. After positive ID confirmation, you may input your newly updated mobile number into the SASSA system.

Verification and Security Checks

It is mainly to eliminate fraud and grant abuse that SASSA enforces profound and rigorous verification. In compliance with this, SASSA will proceed to either authenticate your details or demand an account ownership verification whenever you submit new banking or contact information. These checks will ensure that the grants you are entitled to flow into your account only. At the end of the verification, the system might generate SMS warning updates to be displayed with respect to the results.

SASSA’s Direct Line of Contact

If you cannot get the OTP, have personal information not matching records, or late updating of personal information, you have to get in touch with SASSA. They have offices situated in various environments scattered throughout the country. Upon dealing with SASSA, SASSA offices are your way to go; of course in difficult situations, SASSA’s toll-free helpline is there to assist you. Also, BAS will lend a hand in case you need it; kindly bring your ID and bank confirmation letter to the BAS office.

Sometimes, everything boils down to the basic; in reality, that is all there is to it.

So, this whole charade nicely summarizes the facts about SASSA fax t and cellular numbers and why they are so important. Not that it is quite a quick and convenient process online; yet it is all about the assurance that all the particulars are absolutely accurate and are hundreds of percent security. If you wish to be safe in future, you must also personally check your details regularly, so that you can avoid being caught up in payment-related issues.